Money as a code: the secrets of encryption in banknotes

“The story of money, once begun, is unlikely to ever end.”

Found on the internet

On a wet road, among puddles and fallen autumn leaves, lay a lonely banknote. Raindrops drummed against it like tiny drummers, and despite being slightly crumpled, it pondered its own life. Beautiful.

Every day, a single banknote passes through hundreds of new hands and new fates. I wonder what a banknote could tell us if it could speak?

Something like: “Hello, I’m a banknote. Yes, the very one hiding in your wallet, dreaming of becoming part of something great—like buying you an ice cream or a new gadget. You have no idea how much is encrypted within me.”

Money has long become an ordinary part of modern life. At the same time, colorful banknotes are a powerful source of information and a reflection of the evolution of all methods used to protect truly valuable things.

So why not imagine what a banknote would tell us if it could talk? Let’s dream a little.

The Beginning of Time

A long time ago, instead of me, cows rustled in wallets. Back then, our creative ancestors went to the market with horned assets. They paid for bread with mooing money and received change in the form of clucking investments. Those were good times—no counterfeiters, no wallets. Just living means of payment. Everything was clear, transparent, and honest.

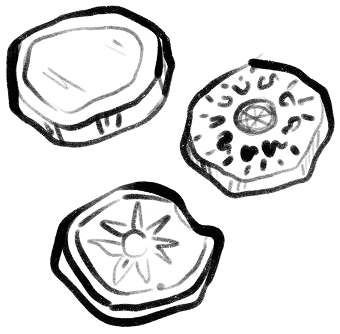

However, traveling with such currency was quite a challenge. So, people had to get creative, and the mooing banknotes were replaced with seashells. A large sack of shell currency was a sign of wealth. A little less prosperous? Pay with beads. No wealth at all? Tough luck. And so, the first counterfeiters appeared.

They did their best to imitate currency—using bones, stones, other types of “non-precious” mollusks, and even casting it in bronze. This is how the first security features emerged. Dark, rare shells were valued higher, while lighter ones were cheaper. Paint worked wonders. But carrying a sack full of such heavy treasures quickly became a hassle. And so, round coins were born.

Coins spread across the world faster than a virus on the internet. Gold was for the rich, silver for those slightly less wealthy, and copper and bronze for the frugal. Even iron was used. Of course, these metal ancestors weren’t as beautiful as I am. But over time, even the barbarians realized that interesting images could be engraved on coins. Thus, rulers, gods, animals, and plants began to appear on round money. Marketing worked even back then.

“It’s Better to Forge Coins Than the Truth”

Diogenes

Over time, progress has advanced significantly, so there was no longer a need to bite coins to test their authenticity. As soon as the first coins appeared, so did those who wanted to optimize their creation process. My historical predecessors have seen it all—from underground forges to modern craftsmen with 3D printers.

I’ve always found these attempts amusing, especially in ancient times. Imagine a master craftsman meticulously casting copper coins and covering them with a thin layer of silver. The result? A golden iPhone in a cheap plastic case with three buttons. It looks convincing—yet not quite.

Fraudsters also practiced “coin liposuction”—shaving off the edges to scrape together some precious metal. The coin would lose weight and become lighter.

The Romans came up with serrated coins, the “anti-theft” technology of their time. The blanks were cast in special molds with ridges, and the final coin was struck over a serrated base. Since the coin was small but relatively heavy, the stamping blow wasn’t too strong, ensuring the edges remained intact.

Thus Began the Evolution of Security

This evolution became especially vibrant with the arrival of paper banknotes. At first, they were mere promissory notes and receipts. Foreign merchants had no idea how to use them. If a bank collapsed, the paper became worthless scraps.

Then came assignats with watermarks and official seals—a technological breakthrough for the 18th century! Governments got serious about money security. Soon, banknotes featured watermarks with halftones, portraits, and paintings by famous artists. At the time, this was as cutting-edge as today’s nanofibers and holograms.

And this is where counterfeiters truly showcased their genius. They started producing engraving plates, printing machines, and stamps. To maintain secrecy, they ordered parts from different cities. Entire underground labs emerged. In response, detectives honed their skills in tracking down counterfeit bills and secret workshops.

So much effort has gone into ensuring that every banknote remains authentic! Take paper, for example. Some banknotes are made of 75% cotton and 25% linen. Others include a luxurious ingredient—silk—allowing them to withstand around 4,000 folds and resist accidental damage.

Or watermarks—a fascinating invention born in Italy by accident. Papermakers, armed with lime and old rags, soaked their materials until they resembled pancake batter. Then, they poured this pulp into molds lined with copper wire. As the water drained, the paper was left to dry. This process left behind faint lines—traces of the wire mesh through which excess liquid had escaped. Soon, craftsmen started experimenting, shaping the wires into simple figures: circles, intersecting lines, letters.

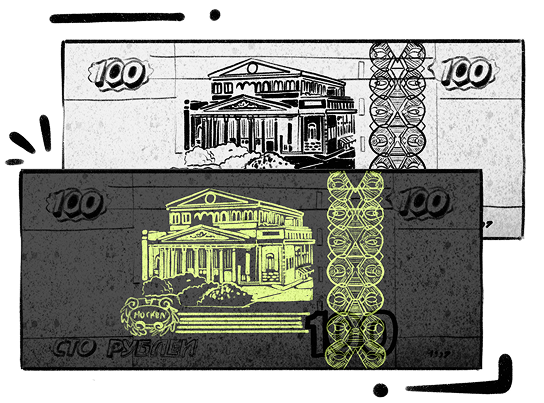

And just look at modern watermarks! On the front of an English banknote, beneath the royal gaze of the Queen, there’s a hidden security thread embedded with alternating letters and numbers—a tiny code that can only be seen through a magnifying glass.

The British pound sterling showcases an incredible transformation: tilt it slightly, and the printed word changes—first displaying “Britain,” then the numerical denomination of the note.

Metallography and Orlov printing remain beyond the reach of even the most advanced counterfeiters. The design is applied with microscopic precision, ensuring perfect alignment of all borders and lines. More impressively, this technique allows a detailed image to be printed in a single pass, achieving nearly 100% accuracy. Replicating such precision is nearly impossible for fraudsters.

And when combined with Swiss SICPA color-changing ink and holographic effects, security reaches a whole new level. Magnetic markers, invisible patterns, protective threads—the armor of any banknote. These threads can be solid or “diving,” featuring text or images.

Polymer banknotes like Canadian dollars employ cutting-edge hidden security. Their design features a maple leaf—if you shine a laser pointer through it onto a wall, the denomination of the banknote appears twice in the projected image.

The metallic thread on the back of banknotes shifts color and vanishes. Under sunlight, it appears silver and seems to “dive” into the paper. Viewed against the light, it becomes a solid dark line.

People love to touch money—even Uncle Scrooge famously dived into his golden fortune, relishing the experience. Banknote designers must have shared this love for tactile sensations. After all, you can verify the authenticity of an English banknote just by running your fingers over the “Bank of England” inscription.

Banknotes also carry an encrypted cultural and historical mission

For example, the front of a British pound features members of the monarchy, while the reverse side showcases “hardcore” British geniuses: Darwin, Fry, Smith, Boulton, and Watt. On some banknotes, Adam Smith’s face changes color, while on others, the £ symbol shimmers. Interestingly, its alignment is slightly off— the aristocrats didn’t quite perfect the first letter of “Libra,” which means “scales” in Latin.

In fact, all graphic elements on currency are a code— and every country has its own.

Conspiracy theorists believe that the symbols on the U.S. dollar— the pyramid with an eye, “New World Order,” and repeated occurrences of the number thirteen— are messages from the Freemasons, the secret rulers of the world.

The reverse side of the twenty-dollar bill features strange concentric pentagons and an abundance of the number 20, chaotically scattered over geometric shapes.

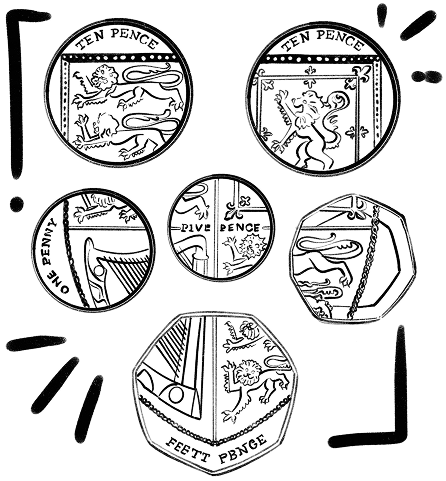

Coins from the Royal Mint can be assembled like a puzzle. The 1-penny, 2, 5, 10, 20, and 50-pence coins form a complete British shield. But why bother assembling them when the full coat of arms is already on the £1 coin? It appears flawed— not perfectly round, but with 12 edges. The royals love their secrets.

The godfather of the ever-green dollar was the thaler. A simple letter mix-up turned “thaler” into “dollar.” Some believe the term “bucks” comes from “green back”— referring to the note’s green reverse side. To this day, no one can fully explain the origins of the $ sign on the American banknote. It resembles both a crucifix and a serpent coiling around a cross. Some speculate it represents the letters “US” (United States), overlaid in such a way that only two vertical lines remain from the “U.”

There’s another story that doesn’t grace the autobiography of the dollar at all. In ancient times, slaves were accounted for in registers and recorded with an S-shaped nail. In Spanish, the word “slave” means esclavo and “nail” means clavo. That’s how the association came about: S-clavo = esclavo. It seems like one small sign, but there are so many encrypted stories.

In 2007, Mongolia issued a coin depicting President Kennedy. By pressing a small button on the president’s right shoulder, Kennedy addressed the holder of the bill with the speech “Ich bin ein Berliner!” (I am proud to be a Berliner).

In the Cook Islands, a coin with a built-in screen featuring John Baird himself, the inventor of mass television, is popular. Now islanders’ wallets hold both money and the real encrypted history of television.

The currency of the state of Benin is shaped like a hemp leaf and has a specific aroma. As soon as you start rubbing this coin made of copper and nickel alloy, it emits an odor. And the numbers on it are unevenly spaced, hinting at the fun features of the continent. The manufacturers solemnly swear that the odor is synthetic and devoid of any psychotropic properties.

Hidden in the silver dollar of the Palau Islands is a holy vessel with real holy water. Very convenient – a piece of the sanctified object is always with you. You don’t have to be afraid of dark forces and can relax.

The road ahead

This brings us to the key point. Today, we have countless forms of currency— both physical and digital. Yet, physical money remains vulnerable, and the demand for enhanced security is paramount. It turns out we haven’t moved too far from the chaotic times of counterfeiting. Yes, we have embedded significant historical events into currency. Yes, we have mastered serial number encryption and holography. But is encryption truly at its peak?

What if we encrypt information not just on the surface of banknotes but within them? Embedding encryption directly into physical money could merge the best of both worlds: the tangibility of cash with the security and transparency of digital encryption. This hybrid model could address many issues faced by traditional currency, including counterfeiting, fraud, and money laundering.

Perhaps, one day, we’ll witness the rise of a new era of “smart” currency — deeply connected to both the digital world and human needs.

Although this concept is still in its infancy, with rapid advancements in encryption technology and the continuous drive for secure transactions, the future of currency may indeed be encrypted.

Don’t believe it? Let’s dream.

Invisible ink and microprinting have long served as “hidden” security features in currency. But what if such protection evolves into something even more advanced — a combination of visible and encrypted information?

Future banknotes could contain invisible QR codes or encryption keys— scannable yet invisible to the naked eye. Such hidden data could be used for tracking the movement of a bill without alerting the public or counterfeiters.

One of the most advanced methods of embedding encryption in physical currency could be RFID or NFC chips — tiny microchips already used in some banknotes and credit cards worldwide. These provide encrypted communication between the bill and nearby devices, ensuring unparalleled security.

The possibilities here are astounding. Each banknote could have an RFID tag uniquely encrypted, providing a signature for authentication purposes. These chips could be used to verify the authenticity of a banknote, dynamically track its movement, or even link it to a specific transaction. Potentially, they could interact with other encrypted devices to ensure currency authenticity and prevent illegal activities such as money laundering.

What is particularly intriguing about RFID technology is that it allows encrypted data to be read remotely, without physical contact. This makes it a seamless and fast method for verifying banknotes during transactions, reducing the likelihood of counterfeit bills going unnoticed.

But that’s not all!

Imagine a banknote equipped with materials that can “self-destruct” if counterfeited or exposed to improper conditions. For example, a banknote could have a material layer that, when altered, causes the encrypted key or identifier to self-erase, rendering it unreadable and effectively making the bill useless. Advanced technology indeed! Researchers are already exploring smart materials that can change color, structure, or disappear when exposed to certain stimuli such as heat, light, or chemicals.

Another way to protect money from counterfeiting is dynamic encryption, where a banknote’s security features change over time. Unlike traditional encryption, where data is fixed, dynamic encryption allows encryption keys to regularly change or rotate, making it extremely difficult for counterfeiters to keep up.

For instance, each time a banknote is used or transferred, it could receive a unique encrypted “stamp” that remains valid only for a limited period. This would make it significantly harder for fraudsters to create convincing copies, as the encryption system could update every time the note changes hands.

Moreover, such a multi-layered approach could combine different types of encryption—one layer for authentication, another for tracking, and a third for privacy—creating an incredibly secure and adaptable system that adjusts based on the transaction context.

We can even dream about each banknote having a unique cryptographic signature linked to a blockchain for authenticity verification and tracking. This concept would provide a transparent and secure ledger for physical cash, allowing individuals and authorities to track the history of each bill with cryptographic proof.

A blockchain-based system could even enable real-time legitimacy tracking of banknotes as they pass through different stages of the economy, ensuring they were never used for illicit activities. However, for this to work, physical currency and blockchain networks would need to be deeply integrated—a complex yet potentially revolutionary concept.

Another experimental technology being explored in academic and cryptographic circles is encryption through light. The idea is that encrypted data could be embedded within the very light patterns emitted or reflected by a banknote.

For example, specific wavelengths of light could be used to create an encrypted message within the note, which could only be detected by specialized optical devices. This could provide a way to encrypt data that remains virtually invisible to the human eye but accessible to those with the right technology. While still a cutting-edge concept, as light encryption advances, it could offer new ways to secure banknotes far beyond traditional encryption methods. Gread.

In Conclusion

The future of encrypted banknotes is full of possibilities. While the widespread adoption of new technologies is still a long way off, the ideas discussed here demonstrate how combining traditional currency with modern encryption and digital technologies could create a much more secure and transparent monetary system in the future. As the world continues to evolve, so too must our methods of protecting the values we hold in our hands, and encryption will play a key role in this transformation.

_________________

“I am not just a piece of paper with encrypted symbols!” – the banknote shouted through the raindrops. “I am a symbol of hope, dreams, and, perhaps, even struggles. I have changed the lives of many people. Someone will surely find me now and decide that I am their luck. Or they will simply buy a chocolate bar with me and give it to someone special.”

In response to the banknote’s thoughts, a young woman passed by, pulling her hood tightly over her head. She stopped, noticed the banknote, and, smiling, placed it in her pocket before heading into the nearest café. The banknote in her pocket smiled too, anticipating that it would make someone a little happier on this rainy evening.

The double-slit paradox awaits you! Learn from particles how to act mysteriously and unpredictably.

Thank you!